These days, it is becoming more common for someone nearing retirement to have an individual stock or equity position that makes up an outsized portion of their retirement portfolio. For our purposes, we’re going to define that as a single position that is greater than 20% or more of someone’s retirement assets.

In today’s world of “Magnificent 7” mega-cap U.S. companies, employee equity grants, ESOPs, RSUs, and other stock based compensation, many investors will be entering retirement with concentrated positions and significant embedded gains presenting tax issues.

Key Takeaways:

- Using long-term capital gains rates for taxable investments to diversify positions in taxable investment accounts.

- Understand what a prudent level of exposure is.

- Utilize modern tools to stay invested and defer gains.

A quick recap on Capital Gains taxes

In Chapter 1, Subchapter P of the IRS tax code – Capital Gains and Losses – describes how appreciated assets are taxed when sold. For our purposes, we’re going to talk about “long-term” capital gains, which refer to the treatment and tax rates for an asset that has been sold but held for a period greater than 1 year. Long-term capital gains have a preferential rate compared to the ordinary income tax rate. For 2025, those rates and income brackets are below:

| Filing Status | 0% Rate Income Range | 15% Rate Income Range | 20% Rate Income Range |

| Single | $0 – $48,350 | $48,351 – $533,400 | $533,401 and above |

| Married Filing Jointly | $0 – $96,700 | $96,701 – $600,050 | $600,051 and above |

| Married Filing Separately | $0 – $48,350 | $48,351 – $300,000 | $300,001 and above |

| Head of Household | $0 – $64,750 | $64,751 – $566,700 | $566,701 and above |

Importantly, there is an income level in which you can harvest capital gains at 0%! Most people will pay long-term capital gains at 15%, which in comparison to ordinary income rates, is favorable.

We should also mention the NIIT (Net Investment Income Tax), which can kick in. This is a premium tax that was passed as part of the Affordable Care Act and is an additional 3.8% on investment income. This would be dividends or capital gains. These brackets are NOT indexed for inflation, and as such, more people will get caught up in them over time.

The 3.8% NIIT applies if your modified adjusted gross income (MAGI) exceeds the following thresholds:

| Filing Status | MAGI Threshold |

| Single | $200,000 |

| Married Filing Jointly | $250,000 |

| Married Filing Separately | $125,000 |

| Head of Household (with qualifying person) | $200,000 |

Deciding what is “prudent”

So how much is “safe” to keep in one individual equity position? This can be viewed through multiple lenses. The first is the potential impact to your retirement plan. If we’re using a Monte Carlo analysis to determine your “probabilities of success,” what would happen if your individual equity position went to zero?

Watching your concentrated equity position and its gains going to zero isn’t inconceivable. History is littered with companies who were “too big to fail” – only to no longer exist in their current form, or even at all. Remember when we all had Kodak cameras and had to get our photos developed? Or Enron? The list is long. Who knows where we’ll be in 20 years? Will Apple still command the same market share of its list of products? Blackberry would like to have a word about that.

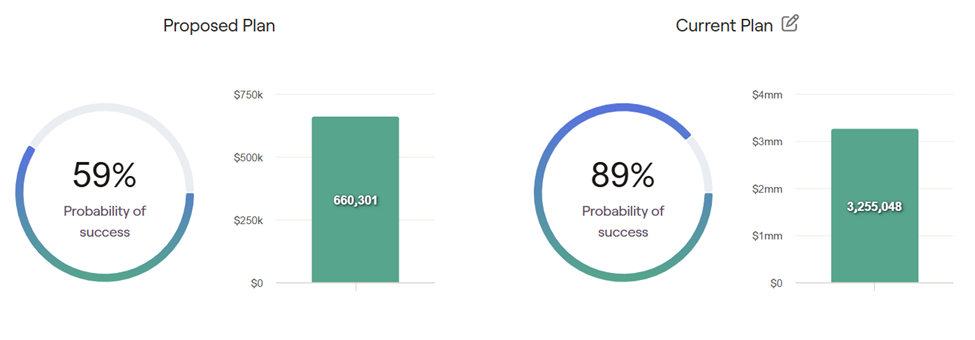

Figure 1.

Understanding the impact to your financial plan if the concentrated position experiences significant volatility or loss is step number one. If your individual equity position represents half of your portfolio, should a significant impairment to its share price occur, your probabilities of success are certainly going to decrease significantly. The example above in Figure 1 would be a good example of what “too much” exposure might look like. Dropping from an 89% probability of success to 59% might represent too much risk to the plan.

So, what level should you shoot for? As a general recommendation, I advise clients to shoot for 10% or less of their overall retirement portfolio. This doesn’t necessarily just apply to concentrated equity positions either. If you’d like to scratch the itch to invest more speculatively, buy cryptocurrency, or take a bit more risk, this can be a useful rule of thumb.

If we’re thinking about managing the possible impact to your probabilities of success, a permanent loss to 10% of your overall portfolio is generally recoverable. Or, at least it requires fewer significant adjustments.

Investments and Tax planning work better together

One of the main reasons concentrated equity positions become so concentrated is the hesitation to sell and incur the tax liability from a paper gain. Fair enough. No tax required until you sell, as reviewed above. We know that if properly planned for, capital gains can be taxed at 0%, or a more preferential 15%. Of course, the NIIT is something to pay attention to as well.

Part of great retirement planning is tax strategy. We’ve written about this elsewhere before, and there is much more to talk about. Prioritizing capital gains harvesting, partial Roth IRA conversions, the Premium Tax Credit, and IRMAA avoidance make this a difficult puzzle to solve.

The reason I wrote about “deciding what’s prudent” first is because that is the first order of operations. There is no tax in the world (other than the estate tax – which is a moot point since you’ll be gone) that is so punitive that it would lower your probabilities of success in the same magnitude as a complete loss of a concentrated position. Said simply, “Prudent investment first, tax second.”

That isn’t to say divesting over time to take advantage of lower rates isn’t prudent. It’s also important to remember that capital gains are “stacked on top” of your taxable income. So, you can’t just look at your capital gains to determine your bracket. You have to put capital gains on top of your ordinary income and then see where your gains fall in the capital gains brackets.

Capital Gains “Bump Zone”

Doing this wrong can actually put some into a “capital gains bump zone” in which you may pay more in capital gains taxes than you did on ordinary income – defeating the whole purpose!

Example: Capital Gains Cause a 55% Effective Rate

Let’s say a retired couple has:

• $50,000 in income from pensions and Social Security

• $80,000 in unrealized capital gains

They think, “No big deal, that $80k will be taxed at 15%.” But:

• Realizing the gain increases AGI

• That causes more Social Security to be taxed

• Pushes them into the NIIT zone

• Maybe triggers the loss of credits or deductions

Result? Their effective marginal tax rate on that $80k gain could exceed 30%–50%.

Charitable Options

A wonderful option for those who are charitably inclined is to donate appreciated stock to the charity of their choice, or a donor-advised fund.

When donating appreciated securities, you are granted a charitable deduction for the entire fair market value of the security. AGI deductions apply, which only allows you to deduct up to 30% of your AGI in the current tax year. However, you can carry over the remaining amount that you were unable to deduct for 5 years.

There is zero realization of any capital gains from the position. And really, you’ve only donated the amount you originally purchased the stock for out of pocket as a true “expense.” A win-win! You might compare this to donating cash – which you can deduct up to 60% of your AGI each year. Of course, your cash doesn’t have any appreciated value.

Lastly, it’s important to remember that you need to itemize in order to get these benefits. So, donating an appreciated security can mean much less “out of pocket” and represent a more sizable donation compared to cash in order to reap the benefit of never paying tax on the gain, but reducing the “out of pocket” amount as well.

Keeping the stock – Step-up in basis

One great feature of the tax code is Section 1014 – “Basis of Property Acquired from a Decedent.” Put simply, when an asset outside of a retirement account is inherited, it receives a step-up in cost basis to the date of death. So, if your concentrated stock is passed to a spouse or to your heirs, their cost basis will be the value of the position as of the date of death. This makes the gain moot, and the position can be sold without any tax implication.

This can be counter-intuitive to some of what I’ve written above, mainly as it is a “hold for forever” strategy. If the position ends up losing a significant amount of value between now and then, then this doesn’t really help. But for long-term planning, it is helpful to know that this can be a fallback strategy.

Keep in mind, however, that this step-up only occurs at death. It does not apply to gifting during your lifetime. Therefore, the tax implication on the person receiving the gifted stock (such as an heir) is no better than the cost basis that you originally had in the stock. In this scenario, the gift might trigger a larger tax burden, especially if the asset has appreciated significantly.

Diversification strategies

The most simple solution to a concentrated position is simply to sell the position and reinvest those proceeds in a more diversified set of assets. But, that’s often not the best tax-efficient strategy, especially if you’re sitting on a significant gain.

Direct Indexing

One tax-efficient way of gradually selling appreciated stock positions and diversifying is direct indexing.

With direct indexing, you own the individual stocks that make up the index, say the S&P 500, instead of the ETF or mutual fund that tracks it. With this method, you can harvest losses as you sell individual positions.

Section 721 – Exchange Fund

Another method is to utilize an Exchange Fund (also known as a Swap Fund), which allows you to contribute appreciated stock into a diversified pool of stocks. This method allows for the deferral of capital gains taxes, with a typical holding period of 7 years.

In Summary

There’s no “one size fits all” approach to managing concentrated stock positions. The right answer involves your goals, risk tolerance, and the level of diversification needed in your retirement portfolio. Consider tax planning strategies that allow you to stay invested and continue to benefit from long-term growth while minimizing your tax exposure.

Work with your financial advisor to navigate these decisions in a tax-efficient way that keeps your retirement plan on track. And if you need help – try giving us a call for our retirement review. We’ll cover your options for navigating complex concentrated positions.