A frequent focus when transitioning into retirement is deciding when to claim your Social Security retirement benefits. There are countless calculators designed to help determine the “optimal” time to claim. However, in practice, this can sometimes create a “forest for the trees” problem—where optimizing your Social Security benefits in isolation may actually reduce your long-term net worth and leave you with less overall, despite the additional funds you received from Social Security.

Key Takeaways

- Optimizing Social Security is often a break-even calculation based on your life expectancy.

- Your Social Security benefits are interwoven with your other financial resources.

- True optimization means looking at all your resources together and evaluating both your probability of success and your final net worth.

How Your Benefits are Calculated

Your Social Security benefit—the amount you’ll receive at your Full Retirement Age (FRA)—is calculated based on your highest 35 years of earnings. Each year you earn employment income (either W-2 wages or 1099 self-employment income), you pay taxes into the OASDI trust fund, which funds the Social Security program.

If you’re evaluating your benefits, you can review your earnings history by logging into your account at SSA.gov or by reviewing your paper statement.

Important note:

- If you’re under age 60, you’ll need to set up a Social Security account (click to set-up an account) online to view your earnings history and benefit projections.

- If you’re over 60 and don’t have an online account, you’ll receive a paper statement about three months before your birthday each year. Once you set up an online account, you’ll stop receiving mailed statements.

Understanding Your Statement

At the top of your statement, you’ll find:

- Name and date of birth – Verify these match your official records.

- Estimated benefits – Quick snapshots of your projected monthly benefits at:

- Full Retirement Age (FRA): Typically 66–67, depending on your birth year.

- Age 70: Includes delayed retirement credits.

- Age 62: The earliest you can claim, though at a reduced amount.

- Family benefits eligibility: On top of your retirement benefits, will be a section on disability benefits, survivor benefits, and Medicare eligibility.

The first page will look like this:

The Earnings Statement

This is the most important—and often overlooked—part of your statement. Social Security bases your benefit on your highest 35 years of inflation-adjusted earnings. Each line shows:

- Taxable Social Security earnings: Income subject to Social Security tax for that year.

- Taxable Medicare earnings: Often higher, since there’s no cap on Medicare tax.

Review this section carefully every few years for accuracy. Even small errors can affect your future benefits, though the good news is that these errors are usually easy to correct.

One of the first ways you can optimize your Social Security benefits is by ensuring you’re actually receiving what you’re eligible for!

You can see an example of an earnings statement below:

Break-Even Analysis

When people think about “optimizing” their benefits, they often assume it means getting the most from Social Security. However, this depends on when you claim—and how long you live afterward. The latter, of course, depends on mortality, which no one can predict with certainty.

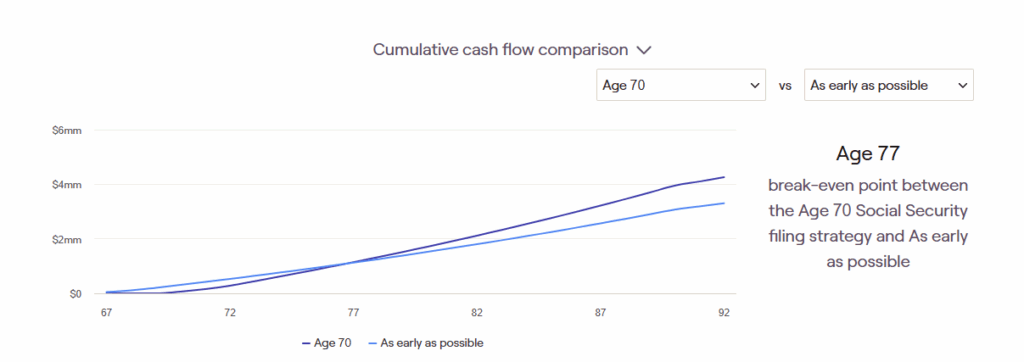

A break-even analysis helps retirees compare different claiming ages. For example, you might weigh claiming at age 62 versus age 70. At what age will the total benefits received by claiming at 70 exceed those from claiming at 62?

The benefit of this analysis lies in its simplicity. Suppose the break-even age is 77. If you live past 77, delaying benefits until 70 results in a higher cumulative payout. In other words, after seven years, the total you’ve received by waiting surpasses what you’d have collected by claiming early.

The Horse-Blinders Problem

So, what’s the downside of relying solely on a break-even analysis? It ignores everything else.

In short, it’s like wearing horse blinders—focusing so narrowly on maximizing Social Security that you overlook how it fits into your broader retirement plan.

Let’s look at an example:

Suppose you retire at age 62. You expect to live beyond age 77, so based on a break-even analysis, you decide to delay benefits until age 70. From 62 to 70, you’ll draw from your investment portfolio to cover living expenses.

But what are the implications of doing so?

- Is your withdrawal rate sustainable?

- What if the market performs poorly during those early years?

- How does that affect the longevity of your portfolio?

- And if you had claimed Social Security earlier, how much more might your portfolio have grown instead?

That last point highlights opportunity cost—the lost potential growth from withdrawing portfolio assets instead of letting them compound. This cost is just as real as the potential gain from delaying Social Security.

And what about taxes? Social Security benefits aren’t fully tax-preferred, but only up to 85% of your benefits are subject to federal income tax. Fewer than a dozen states tax Social Security at all. All else being equal, it might be more tax-efficient to claim Social Security earlier rather than taking additional IRA withdrawals.

Once you start asking these questions, it becomes clear that a simple break-even analysis often falls short of identifying the most beneficial claiming strategy.

What Really Matters

Every client I work with has unique goals and circumstances. Some want to maximize their Social Security benefits above all else—in those cases, it makes sense to give more weight to the break-even analysis.

However, if your goal is to optimize within the broader context of your financial plan, then it’s important to consider your other resources, tax implications, and overall probabilities of success.

In Summary

You can begin optimizing your Social Security benefits simply by paying attention:

- Make sure your earnings and benefits are calculated correctly—errors are common.

- Decide what you’re actually trying to maximize:

- Your income?

- Your total lifetime Social Security benefits?

- The amount you leave to heirs?

- Your long-term probability of financial success?

- The total taxes you pay over your lifetime?

None of these are wrong answers—they just lead to different claiming strategies. You may end up choosing a claiming age you didn’t expect, and that’s perfectly fine.

Ultimately, optimizing your Social Security benefits isn’t about beating the system—it’s about aligning your choices with your goals, resources, and definition of success.