Our Expertise

Tax-smart retirement planning is our specialty.

Let us show you how.

Navigating Your Retirement with Confidence

Retirement should feel like a day at the beach—relaxing, rewarding, and worry-free. We handle the

complexities of navigating retirement finances so you can focus on enjoying the lifestyle you’ve earned.

Investment Management

Estate Planning

Tax Planning

Social Security

Insurance & Medicare

Retirement Income

Investment Management

We build investment portfolios around your retirement goals, focusing on managing risk and growing your wealth. Our primary goal is making sure your money lasts and you don’t have to sacrifice the lifestyle you’ve dreamed of.

There are 3 key principles that keep your portfolio on track:

- Follow the Evidence

According to Morningstar, one of the biggest factors affecting a fund’s performance is its cost. For this reason, we often use simple building blocks like index funds in portfolio construction. - Minimize Taxes

Minimizing taxes starts with placing the right investments in the right accounts. High-income investments in taxable accounts can lead to bigger tax bills, leaving you with less. We also time portfolio adjustments carefully to avoid unnecessary tax costs, helping you keep more of what you earn. - Know What You Own

Investments that are hard to sell or lack transparency don’t contribute to a secure retirement. We believe you should know what you’re invested in—because transparency and liquidity play a big role in making your money last.

Estate Planning

Many clients worry about what will happen to their finances if they’re no longer around. We’ll create a plan designed to give you peace of mind, that includes:

- Helping your spouse feel financially secure and ready to manage household finances with confidence

- Making sure your assets are passed down in the best way to benefit your family

- Regular review of estate planning documents for legal changes and family updates

- Charitable giving strategies and planning

Estate planning is about continuing to achieve your financial goals even when you’re not here. We’ll make sure this continuity is in place, and will gladly work with your next generation at discounted or household fees where appropriate.

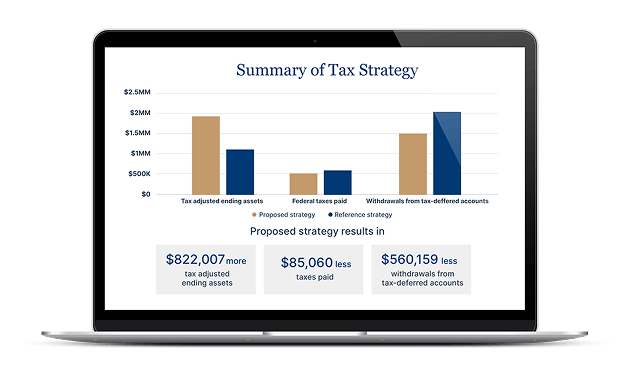

Tax Planning

The number one rule in tax planning: The less tax you pay, the more you keep and spend in retirement. Our goal isn’t just one year, it’s reducing taxes over your lifetime. You can expect:

- An annual tax return analysis, along with a tax preparation letter for your tax professional

- Annual Roth Conversion review and planning

- Coordination of retirement income (Pension, Social Security, Required Minimum Distributions, etc.)

- Asset location

- Charitable giving strategies

- Avoiding IRMAA penalties

As tax laws change, so will your strategy. We are up to date on the latest tax law changes so you don’t have to be. You can read more about tax planning in our Blog.

Social Security

As part of your overall retirement plan, you’ll want to make sure you understand the optimal time to claim Social Security. This isn’t as simple as running an optimizer. We’ll make sure your strategy:

- Incorporates your other sources of income

- Increases your chances of long-term financial success

- Works to minimize your overall lifetime tax liability

Social Security isn’t just a break-even calculation. We’ll factor in spousal benefits, health conditions, personal preferences, and more in determining the approach that is best for you. We make sure our clients get this right.

Insurance & Medicare

Medicare can be confusing, but we’re here to help. While we don’t sell health insurance, we’ll guide you in avoiding IRMAA penalties, enrolling at the right time, and choosing between Medigap and Medicare Advantage.

Making the right choices can have a big impact on your finances throughout retirement, and we’ll help you navigate the details with confidence.

- Navigate Open Enrollment

Health insurance can be as confusing as it is critical. If you need help working with a broker or deciphering your options, such as the differences between Medicare advantage and Medigap, we’ll make sure you have the details you need to choose the right health coverage. - Protect your loved ones

You can rest comfortably knowing your loved ones will be taken care of financially if something happens to you. We’ll review your financial and personal details to determine if you have a need to keep or purchase new life insurance. - Address the Gaps

To make sure you’re not overlooking any detail, we’ll review your personal, home, auto, and umbrella coverages. We’ll confirm that you’re spending the right amount to protect against the unseen risks that can lurk around your nest-egg.

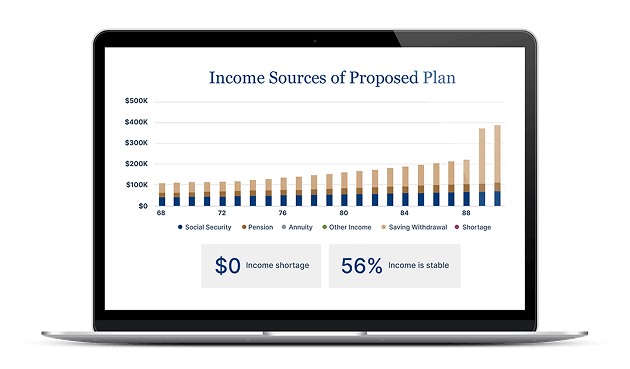

Retirement Cash Flow

How you should take your money out of your nest-egg is as much art as it is science. When you put together your retirement income plan, we think it should check the following boxes:

- Minimize your lifetime tax liability

- Confidently help you live your ideal lifestyle

- Maximize your investment return

- Reduce unnecessary risks

- Eliminate unnecessary costs and roadblocks

Retirement has been studied extensively for decades. We rely on the latest research and best strategies to guide our advice on all areas of retirement income such as Social Security, Pensions, Rental Properties, Required Minimum Distributions, and more.

The Different Approach You Deserve

Who We Are:

Transparent Communication

You’ll always know where you stand. We communicate regularly and its super easy to see your investments and planning in one place.Expert Guidance

With years of experience in investment management and financial planning, we simplify complex decisions. You can expect our advice to be backed by the latest research and strategies.Proactive Planning

Life changes, and so should your plan—we proactively adapt to new opportunities and challenges, helping you stay on track and make the most of your wealth over time.

What We Don’t Do:

Tack On Hidden Fees

You’ll always know exactly what you’re paying with our clear and upfront pricing, so you can focus on your goals without worrying about hidden costs or surprises.Compete With Your Best Interests

Your goals come first. Every recommendation starts with your best interest in mind. No hiding conflicts of interest.Recommend a Generic Plan

Your financial plan and investment strategy are built around you and your unique vision for your life, not a one-size-fits-all approach. We work with a limited number of families to keep customization high and focus on your success.

Retirement Success Case Studies

Working by Choice

David and Sarah love their careers. As they approach traditional retirement age, they wonder if they’re overlooking something.

Already Retired

Tom and Donna have just hung up their work hats and have big dreams for using their hard-earned savings, but aren’t about to jump in without a solid game plan.

Retiring Solo

Dana is 66, has more than enough to comfortably retire, and matter of fact she came to that conclusion a while ago. However, she is still working.