Navigating your investments during retirement is a delicate balance of managing risk and pursuing adequate returns to offset portfolio withdrawals. In this post, we’ll examine one of the most basic tenets of portfolio risk management—rebalancing—and what might work best for you.

Key Takeaways:

- Portfolio rebalancing reduces the risk or volatility of a portfolio’s returns.

- Various methods can be inconsistent in their effectiveness.

- The “best” rebalancing strategy is often more about luck than precision—which is why you should rebalance at least on some regular basis.

What is Re-balancing?

Rebalancing is rooted in Modern Portfolio Theory. In 1952, Harry Markowitz wrote his groundbreaking paper Portfolio Selection. This research formalized the trade-offs of including multiple asset classes in portfolio construction and highlighted the importance of weighting asset classes.

The core idea: as your asset allocation shifts over time, so will your returns. That’s the foundation of rebalancing. The key question becomes: how often should we adjust allocations or trade our portfolio back to its targets?

We’ll take a look at the various reasons, methods, results, and opportunities of re-balancing, but the most important thing is that you have a plan on how you’ll approach investment management over the course of your retirement years. With that, let’s dive in……

Why Re-balance?

Every retirement portfolio is designed with a target allocation tailored to a financial plan—say, 60% U.S. stocks and 40% U.S. bonds. Such an allocation is chosen because it offers the best chance of meeting milestones. (This is a hypothetical example for ease and not a recommendation of how you should invest your retirement portfolio!)

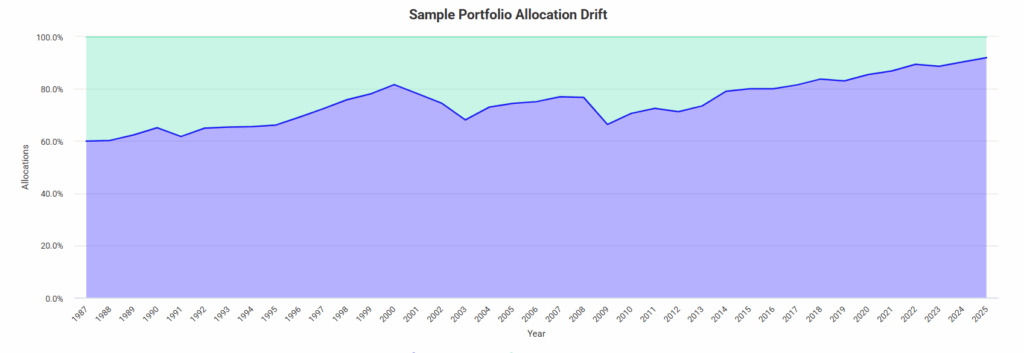

Over time, equities tend to outperform bonds. Without intervention, a portfolio generally becomes more “equity heavy.” For instance, if you retired in 1987 with our hypothetical 60/40 stock-bond mix, by 2000 that portfolio would have drifted to 81.63% equity and 18.37% fixed income, as seen below.

The longer you go, the more equity-heavy your portfolio will be expected to become. This is a feature, not a bug. The longer you let your equities run, the heavier weight it will become in your portfolio.

How does Rebalancing affect performance?

Maintaining your chosen allocation is a major driver of both performance and risk. Our “unrebalanced” portfolio from 1987–2025 compounded at 9.64% CAGR with a standard deviation of 11.86%. You should remember your chosen asset allocation will be the biggest driver of your returns over the course of your retirement. The standard deviation is telling you more about the ride on the way to capturing these returns.

Think of standard deviation as the width of the bell curve around average returns—the higher it is, the greater the potential swings. Equities naturally have higher standard deviation than bonds, so as a portfolio drifts equity-heavy, both risk and potential return increase.

By introducing rebalancing, we dampen that drift, and hypothetical volatiliy. For example, a simple annual rebalance would have produced 8.88% CAGR with a standard deviation of 9.86%. That’s an 8% reduction in return but a 17% reduction in volatility.

Re-balancing best reduces risk when you are properly diversified. Said another way, if everything is performing the same, re-balancing doesn’t have much of an effect. However, you haven’t really reduced risk by introducing un-correlated asset classes. You can’t buy low and sell high if everything is moving in lock-step.

Rebalancing in retirement

Retirement brings many unknowns—longevity, inflation, spending, returns, taxes. One way to make this problem more manageable is to build certainty around your needed rate of return.

If your plan requires 7% annual returns, the ideal portfolio would generate a steady 7% each year. But markets don’t cooperate: returns arrive out of sequence, often far above or below the average. This sequence risk is where rebalancing can play a role, reducing volatility at the cost of some return in exchange for more predictability.

Case study 1987-2017

Let’s compare a $1,000,000 portfolio using the 4% withdrawal rule:

| Metric | Rebalanced Annually | No Rebalancing |

| Final Wealth | $3,966,244 | $4,200,247 |

| Money-Weighted Return (MWRR) | 9.60% | 9.73% |

| Volatility | 9.20% | 10.84% |

| Maximum Drawdown | -30.72% | -37.38% |

| Worst Underwater Period | 3 years 5 months | 4 years 11 months |

The unrebalanced portfolio slightly outperformed in absolute returns (13 bps annually over 30 years). But note the trade-offs: the rebalanced portfolio recovered more quickly, shaving 19 months off its worst underwater stretch. For retirees, that stability may be far more valuable than a small performance edge.

From an emotional standpoint, getting back to the all-time high value of your portfolio 19 months sooner is a far more desirable outcome for most retirees. And only at a cost of 13 basis points per annum!

Rebalancing as a return generator

We often think of rebalancing purely as risk control. But in practice, it can also accelerate recovery from downturns.

Rebalancing forces you to “sell winners and buy losers.” During market crashes, this means adding to equities at depressed prices, positioning your portfolio to rebound faster. It’s one of the reasons you see a lesser underwater period.

Not only are you down less, but an active re-balance strategy will add shares of depressed equities to your portfolio which acts as a tailwind upon recovery.

Types of Rebalancing strategies

In our opninon, there’s no single “best” strategy—only trade-offs. What most academic research has found on re-balancing is that the “best” performing strateiges did so due to luck. They just happened to trade, or re-balance right around peaks or valleys in markets. Not because of some profound insight. As such, trying to determine the “best” re-balancing strategy by looking in the rearview mirror is a bit of a fools errand.

The best re-balancing strategy over the next 30 years will amost certainly be different than the last 30.

The main categories of re-balancing strategies are:

- Time-Based (Calendar)

- Example: annual, semiannual, quarterly, or monthly.

- Simple, but introduces timing luck—sometimes you’re forced to trade at inopportune moments.

- Tolerance-Based (Bands)

- Example: 20% target position with a ±10% band, allowing drift between 18–22%.

- Reacts to actual portfolio changes driven by market peformance instead of arbitrary dates.

- Often more effective, since it sells winners and buys losers only when drift exceeds limits. Depending on the risk tolerance of your portfolio, these bands can be widened or tightened.

- Timely or Tactical

- More discretionary, using valuations or expected returns as signals on making asset allocation and rebalancing decisions.

- Riskier and harder to execute consistently for DIY investors, though more recent research from Wade Pfau and Michael Kitces suggests valuation-based rebalancing can improve retirement outcomes.

Most professional strategies combine tolerance bands with occasional tactical considerations. For our clients, we use a mix of tolerance-based and timely re-balancing decisions using our forward looking capital markets assumptions. The most important thing for most investors, is that you have a plan or method and stick to it.

In Summary

We’ll dive deeper into each of these strategies in future posts, but the bottom line is clear: every retiree should include some form of rebalancing in their risk management approach.

Rebalancing reduces time spent underwater, smooths volatility, and helps you navigate turbulent periods with greater confidence.

If you’re not sure how your portfolio is being rebalanced, schedule a review here.