This topic has been one that has been studied in academia and has many different rules of thumb that can leave those approaching retirement confused and make less than optimal decisions. We’ll take a look at some of the more popular “rules of thumb” as well as how we work with our clients to develop a unique investment strategy to best navigate your retirement years.

Key Takeaways:

- Risk transforms in retirement and will likely require a dynamic asset allocation process

- Common rules of thumb probably will not be sufficient in offsetting required returns for most individuals

- Asset allocation decisions are the biggest driver of returns and probability of success

What got you there will not get you here

In academic finance, we refer to the transition from working to retirement as the move from the accumulation stage to the decumulation stage. In plain English, flows from your accounts move from in, to out. The direction in the flow of money changes how you think about investing.

Over the course of your working career, a successful accumulation investment strategy was accomplished by a few things:

- Saving as much as you can

- Pursuing as aggressive returns as you can tolerate

Portfolios during this stage in life are positioned as growth-oriented as possible. We know that the more aggressive the portfolio, the more volatility it will experience. However, due to the ongoing in-flow of dollars, volatility works as a tailwind.

As a simple example, let’s say you own one XYZ fund. The share price of that fund is $100. If you are putting $100 in from every paycheck, you would purchase 1 share each pay period. If the fund dropped 20% the resulting share price would be $80. So, that $100 contribution would purchase 1.2 shares. Market volatility has aided in you accumulating even more assets!

You might think that you are losing money in the above example. However, during your working career your time horizon is as long as it will ever be. So, assuming capital assets (especially stocks) increase in value over time, this is a winning formula for accumulation.

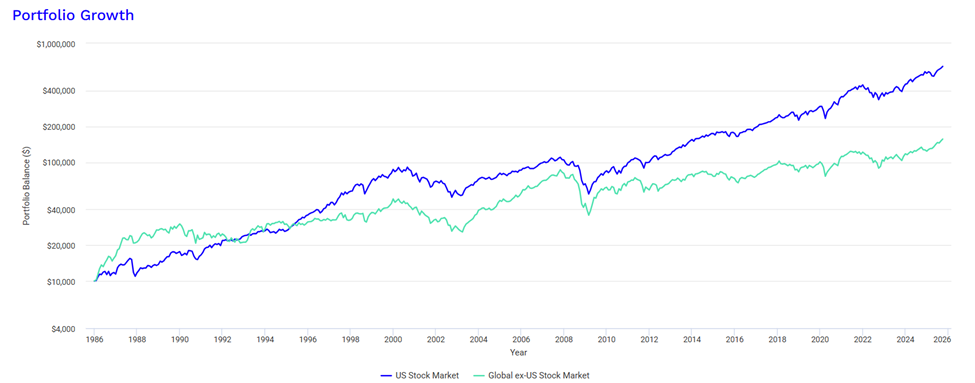

You can see the growth of $10,000 in the U.S. stock market, and global stock market since 1986 below. Not too bad!

The problem comes as you transition into retirement. That same math that serves as a tailwind turns into an immediate headwind when you enter retirement.

Using the same example above, let’s say instead you are distributing $100 a month from XYZ fund in your IRA. If that same $100 fund loses 20%, you will need to sell 1.2 shares to get the same $100. Instead of accumulating more shares, you are decumulating your assets you’ve built even faster!

I’m not sure who coined the term, but BlackRock calls this “dollar cost ravaging.” A small play on the “dollar cost averaging” strategy that acts as a tailwind while in the accumulation stage.

Sequence of Return Risk

The “dollar cost ravaging” effect has an academic name – sequence of return risk. As we saw above, stocks historically appreciate over time. That is not to say that is a free ride – periods of volatility do occur.

Can we expect similar returns to history? More or less seems to be a reasonable expectation. What we cannot predict however, is what returns will happen year after year. Let’s take a look at two portfolios with the same 4% average return over 5 years. Portfolio A has a “positive sequence” or good returns in the first two years. Portfolio B is the “negative sequence” or poor returns in the first two years. Take a look at the difference:

Portfolio A:

| Year | Return | Start Value | Withdrawal | End Value |

| 1 | +20% | $1,000,000 | $50,000 | $1,140,000 |

| 2 | +10% | $1,140,000 | $50,000 | $1,204,000 |

| 3 | 0% | $1,204,000 | $50,000 | $1,154,000 |

| 4 | -10% | $1,154,000 | $50,000 | $992,000 |

| 5 | -20% | $992,000 | $50,000 | $753,600 |

Portfolio B:

| Year | Return | Start Value | Withdrawal | End Value |

| 1 | -20% | $1,000,000 | $50,000 | $760,000 |

| 2 | -10% | $760,000 | $50,000 | $639,000 |

| 3 | 0% | $639,000 | $50,000 | $589,000 |

| 4 | +10% | $589,000 | $50,000 | $592,900 |

| 5 | +20% | $592,900 | $50,000 | $651,480 |

Sequence of return risk becomes problematic, especially in the first few years of retirement. Why? Because in the first few years of retirement is when our time horizon is the longest. The same thing that used to be our biggest asset now is one of our biggest risks: Will our portfolio be large enough to outlive us?

The difference between Portfolio A and Portfolio B at the end of the first 5 years is 10.2%. That’s a smaller portfolio to attempt to navigate the remainder of your retirement years through no fault of your own, just the random luck of whether the good or bad years happen first!

Investment Implications

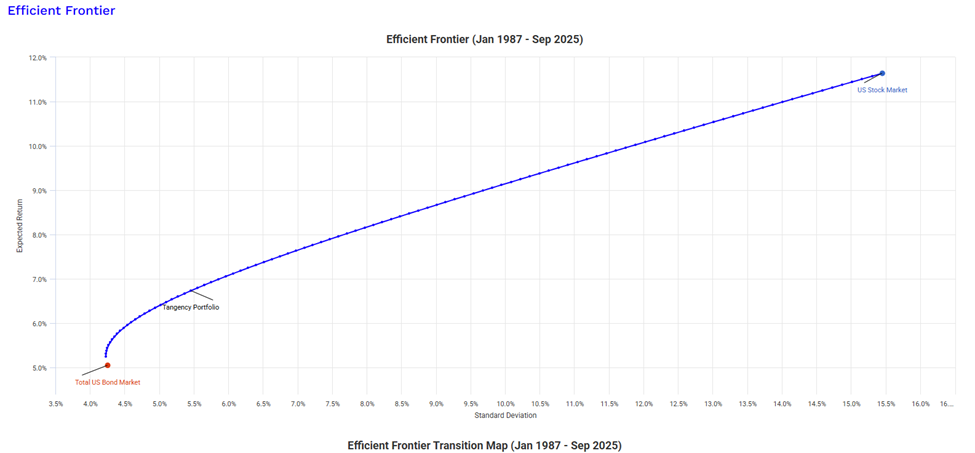

As you might be thinking, the more aggressive my investments, the more you expose yourself to sequence of return risk. While “risky” assets tend to have a higher payoff or return, the possibility of a loss, or volatility also increases. Below is what we call an “efficient frontier” of investment assets. Graphically, what we see is a mix of U.S. stocks and U.S. bonds. The more we increase our exposure to U.S. stocks, the more expected returns would have increased. However, moving right on the X axis also increases our standard deviation, or volatility. The more volatility, the more return, but the more we expose ourselves to sequence of return risk.

So this brings us back to the question at hand: so should I be more conservative to help mitigate sequence of return risk?

What Does Your Plan Say?

The most important part of your investment allocation is your financial plan. When I talk about “financial plan” I mean the discussion you should have with regard to what your withdrawal needs are going to look like over the course of your retirement. This includes specific goals, hopes, aspirations, legacy objectives, philanthropic priorities, and anything else you hope your portfolio might be able to do for you.

The timing and duration of your cash-flows matters significantly to how you might structure an asset allocation or investment strategy. We’ve also talked about how to craft a withdrawal strategy for your retirement dollars here.

In short, your plan will require a certain rate of return as to not deplete your assets prior to your life expectancy. We can use this rate of return to generate a portfolio of assets that historically would have worked, and with our capital markets assumptions believe have a good chance of working in the future.

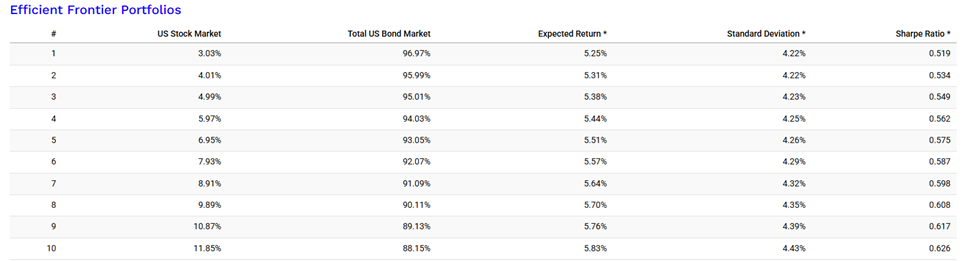

Using the efficient frontier chart above, we can mathematically calculate various portfolios to that would have had a specific expected return that might be sufficient for our plan. You can see some of those below:

You’ll notice the expected return of each portfolio increases along with the U.S. stock allocation, along with the standard deviation. This can be a useful starting point to arriving at what might be a suitable retirement portfolio allocation.

Note: this is a completely simplistic hypothetical example only using two asset classes, U.S. stocks and U.S. bonds. Your planning and portfolio are different, these are not specific recommendations.

Risk Transforms

Once we can arrive at a roughly approximate appropriate asset allocation, I like to come back and think about how specific risks apply to certain unique individuals. As an example, for a couple who is retiring at age 60 and has life expectancies of 90+, the primary risk is longevity. Will the current portfolio be enough to satisfy all lifetime income requirements? 30 years is a long time!

However, the same is not necessarily true of someone who is 10 years into retirement, age 70 with the same life expectancy. Not that 20 years is not a long time, but longevity risk may not be as large of a concern. These individuals may also not be travelling as much as they had prior, and spending is on the decline. Some discussions may start to be around having enough funds for any health expenses later in life.

For someone who is 80 and been retired for 20 years, longevity usually is not in the top few risks we’re thinking about. The risks are usually around sudden health events, stability of resources, and tax and transfer issues.

We might conclude that the same portfolio, despite all 3 being retired and having the same “return need” at the beginning of their plan, now require different portfolios.

Sequence Risk First

The first risk any of these 3 individuals will face will be the longevity piece. We do not have to worry about having money at age 80 if we do not properly navigate the first 5-10 years of retirement!

In our efficient frontier example, you will notice that while U.S. bonds have a much lower historical return, they also have a much lower standard deviation.

In navigating sequence of return risk, this is an ideal trait. We have a more predictable return stream. However, the net real returns may not be sufficient to meet the objectives of our plan.

In the early years of retirement, positioning the portfolio to maintain a dedicated allocation to bonds or other conservative assets may create a bit of a “tent” or buffer from which to withdraw from. I usually like to do this for the first 3-5 years of an individual’s retirement.

Dynamic, Not Active

When I talk about investments I will use the bar of soap analogy, which goes something like “the more you play with it the quicker it disappears”. That does not mean you should not change things at all!

In the years leading up to your retirement date, establishing this “buffer” creates more certainty around the overall volatility of the portfolio, but also specific withdrawal needs. You will not be selling any stock shares that are more volatile by nature in the first few years of retirement.

Once you make the transition into retirement, you will start spending down some of your buffer assets. This has two benefits:

- The assets being spent down in the first 3-5 years of retirement have a lower volatility and as such we reduce the possibility of exposing ourselves to a bad sequence of returns

- Naturally, our portfolio is getting more growth-oriented as we spend down our conservative assets. Thus, aligning the portfolio more with one that likely achieves our return target of our planning!

Outside of your “buffer assets” – your asset allocation should resemble something close to alignment with a portfolio that targets your required return.

So, over time, your asset allocation as you age will likely get more growth-oriented. This will happen not as a result of trying to “time the market” or judge the outcomes of various geopolitical events.

On the contrary, it will be a portfolio that accurately reflects the risks and requirements of navigating retirement.

Case Study

To make things simple, let’s say we have Jack and Diane who are retiring at age 65 with $1,000,000 in their retirement portfolio. During a thorough discussion and planning process, we have determined their initial cash-flow need to be approximately $40,000/year.

After accounting for inflation, we have determined their target nominal return to be approximately 6.5% or 4.5% after inflation. The appropriate asset mix under our capital markets assumptions is somewhere between 60%-70% stock and 30-40% fixed income.

To navigate sequence of return risk, we’ll allocate approximately $120,000 to short-term fixed income outside of their target allocation. This is the “Bond tent” – 3 years of their initial distributions.

Their initial portfolio as a result of the “bond tent” will be closer to 52% – 61% equity. Over the first 3 years, their distributions will occur from selling the “bond tent” positions. After 3 years, their allocation will have returned to 60-70% equity, despite being 3 years older and in retirement.

In Summary

Sequence of return risk provides an extreme challenge for anyone near retirement. It is simply one of the many unknowns retirees will have to contend with. However, we think this is one strategy investors can use to help mitigate the risks early on.

Over the duration of retirement, your asset allocation will be the biggest driver of returns and what matters the most. As sequence of return risk becomes more of a rear-view mirror phenomenon, retirees can probably take on more growth-oriented allocations than they think.

So, should you get more conservative in retirement? Initially, probably. But the best evidence would say staying that way is not too prudent.

If you have questions about your investment strategy going into retirement – feel free to ask them starting here.