Many retirees find themselves watching CNBC more frequently once they’ve left the workforce. It’s a natural shift—when your portfolio becomes the engine sustaining your lifestyle, every market movement feels more consequential. The endless parade of pundits talking about investing opportunities can make stock picking seem both exciting and necessary for portfolio growth

As someone who primarily works with successful retirees, it’s a question I see often. Many of our clients had success in picking stocks to accumulate wealth in the first place! At this stage in life, the question isn’t whether you can pick stocks—it’s whether you should.

Key Takeaways for Retired Investors

- Individual stocks offer asymmetric trade-offs. The potential for gains is uncapped, while you can only lose 100% of your investment

- Excessive portfolio concentration in individual equities magnifies the unique risks facing retirees, including sequence of returns risk

- Historically, most active strategies attempting to outperform passive benchmarks through stock selection have failed over extended periods

A note from Warren Buffett on the subject:

Warren Buffett, arguably the most successful investor of all time, has acknowledged the challenge: “Over the years, I have made many mistakes. Our satisfactory results have been the product of about a dozen truly good decisions—that would be about one every five years.”

If the Oracle of Omaha only makes one truly good decision every five years, what does that tell us about the average investor’s or your own odds? As we’ll talk about, one or two good stocks can make an entire portfolio. But the odds of striking such gains, is improbable.

Why Retirees Consider Stock Picking

For most of our clients, I often say they’re starting the marathon around mile 20. They’ve done the heavy lifting during their working years and have accumulated more than sufficient resources to retire comfortably.

In plain terms: let’s just not mess it up now.

Some of our clients have built wealth through concentrated positions in individual stocks. The success can influence our confidence and judgement with what strategy may work best moving forward, in the face of statistics that tell us quite differently. Previous success or gains create an intuitive appeal—a stock can only lose 100% of its value, but there’s no ceiling on potential gains. Finance professionals call this asymmetric return potential. The appeal only grows stronger when a client comes to us having seen it first hand.

The Math Behind Stock Market Returns

We know the stock market appreciates over time. But here’s what most investors don’t realize: this isn’t because all stocks go up.

Arizona State Professor Hendrik Bessembinder published what was at the time, groundbreaking research in 2017 revealing that 58% of individual stocks have underperformed Treasury bills since 1926. The market’s long-term appreciation comes from a remarkably small number of exceptional performers.

Bessembinder analyzed 25,782 companies from 1926 to 2015 and found:

- Just 1.1% of companies were responsible for 75% of all wealth created

- Only 4% of companies generated the entire wealth created over this 89-year period

So really when picking stocks, we’re hoping to find a few in that 4% that will drive the majority of returns for the market and your own portfolio.

Amazon is a great example that exemplifies the potential gains from finding a winner, compounding at 36% annually above cash since going public through 2015—essentially doubling investors’ money every two years.

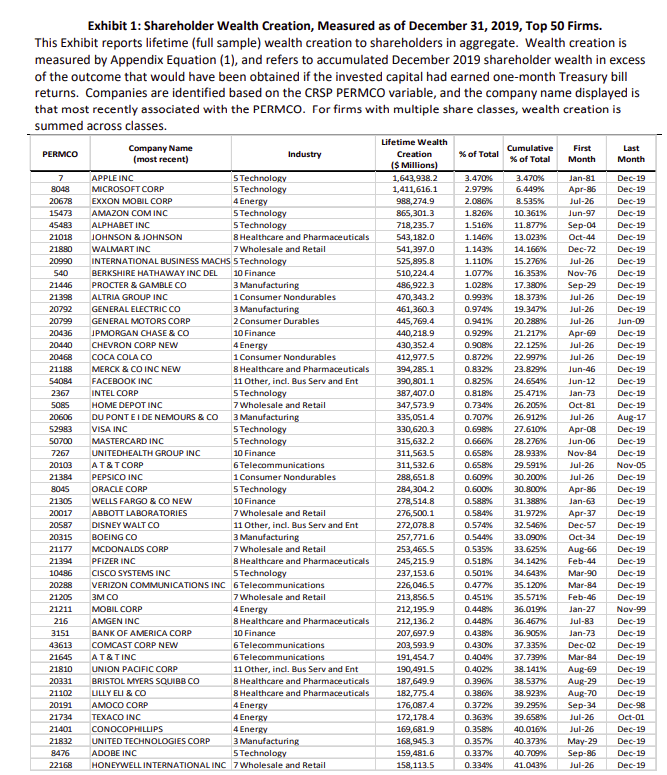

It’s easy to focus on the returns. But finding the next Amazon? That’s like finding a needle in a haystack of 25,000+ needles. You can see the top 50 firms by shareholder wealth creation from 1926 to December 2019 below. There are some names your likely familiar with.

Do Professional Money Managers Beat the Market?

Perhaps professional investors with extensive resources and research teams can overcome these odds. The data suggests otherwise.

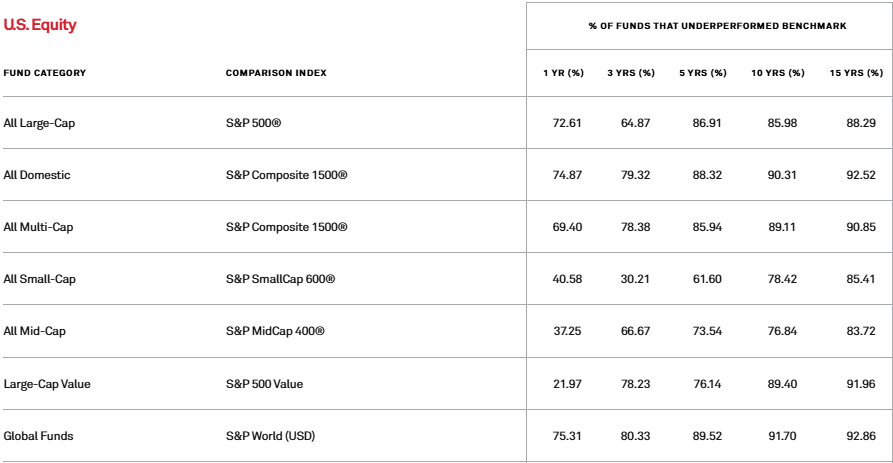

The S&P Dow Jones SPIVA (S&P Indices Versus Active) report tracks how professional fund managers perform against passive index benchmarks. The short-term results appear encouraging—30-75% of professional managers beat their benchmarks over one-year periods in U.S. equity categories.

However, as the time horizon extends, the probability of outperformance drops dramatically. As of the end of 2025, 88.29% of large-cap U.S. funds underperformed the S&P500 over the last 15 years. Why? Remember Bessembinder’s research—only 4% of stocks deliver outsized returns. Consistently identifying this small group of winners becomes statistically improbable over time, even for professionals. You can see the results from SPIVA below:

Not only is picking the small group of winners difficult, but we’ve seen significant market concentration in the U.S. over the last several years. An active manager would have had to have been even more concentrated. Putting more than 40% of clients money in 7 stocks. Who would have predicted or said that is a prudent way to manage money? Yet, those 7 stocks have been the biggest winners of the last decade and commanded a larger share of the passive index.

When the odds are consistently against you, and the challenges of what it takes to outperform, it isn’t as if you can’t win in the short-run. Much like the casino. But a failure to stop when your up and chasing the previous wins, will only lead to losses (or underperformance). It’s the consistency of winning that has such a low probability. For retirees, we’re planning on a 20+ year time horizon. Can your stock picking strategy work for that long of a period? Unlikely.

Access to professional strategies via mutual funds, ETFs, and separately managed accounts creates a second layer of difficulty: not only must you pick winning stocks, but if you’re delegating to active managers, you must also identify which managers will be among the minority who succeed.

This again isn’t to say it isn’t possible. There are managers that have a long-term track record of outperforming their passive benchmarks. The failure rate over 10-, 15-, and 20-year periods isn’t 100%. However, identifying them will be equally as difficult as picking the stocks themselves. If we use the SPIVA data above, over the last 15 years only 12% of large-cap managers have done better than the index. 1 in 10 odds.

What This Means for Your Retirement Portfolio

Retirees face unique challenges that make portfolio management particularly critical: inflation risk, uncertain spending patterns, healthcare costs, and the dreaded sequence of returns risk (suffering losses early in retirement when you’re also making withdrawals).

Our goal is maximizing the probability of financial success throughout retirement. Given that the odds of beating passive indices are stacked against even professional investors, why take that risk with the bulk of your portfolio?

The data strongly suggests that the majority of your retirement portfolio should be invested in low-cost passive index funds.

This doesn’t mean active strategies or individual stocks have no place. The research clearly demonstrates that outperformance is possible—just not probable. For most retirees, I recommend keeping active strategies or individual stock positions to less than 10% of the total portfolio.

We’re following the evidence as to the probabilities of having the “winning” strategy and not leaving returns on the table.

The Behavioral Case for Controlled Stock Picking

A mostly passive investment portfolio can feel boring. And frankly, investing in individual stocks is fun. It’s an engaging way to participate in capitalism, follow companies whose products you use, and continue learning about business and markets. I tell clients all the time I’ve owned Berkshire Hathaway since I started investing and hope to pass it down to my kids. I like to think Warren Buffett would be appreciate the strategy.

From a purely statistical standpoint, dedicating portfolio space to stock picking isn’t optimal. But investing, like life, isn’t a zero-sum game. Allocating a small portion of your retirement portfolio to individual stocks or active strategies can make it psychologically easier to stay the course with your core holdings.

Sometimes doing a little bit of the “wrong” thing makes it more likely you’ll do the right thing over the long haul. And in retirement planning, staying the course is really what matters most.

Creating Your Retirement Portfolio Strategy

If you’re approaching or in retirement with $2-5 million in investable assets, your primary goal should be preserving wealth and generating sustainable income—not swinging for home runs just because it may have worked before.

A sound approach for most retirees:

- Core holdings (90%+): Diversified, low-cost index funds providing broad market exposure

- Satellite holdings (up to 10%): Individual stocks or active strategies for engagement and potential outperformance

- Clear withdrawal strategy: Systematic approach to generating retirement income regardless of market conditions

- Tax efficient investing that doesn’t give more of your returns to the government than necessary

Working with a fee-only fiduciary advisor can help you implement this strategy while avoiding the conflicts of interest inherent in commission-based advice. If you have questions on how to implement a core investment strategy for your retirement, you can reach us here.