I used to get the question all the time: “What’s that thing that happens around age 70?” For much of my career, the age was 70½. Now, it’s 73. The “thing” is a Required Minimum Distribution (RMD). In this guide, we’ll cover the who, what, why, and how of RMDs—and everything else you need to know once you approach that magical age.

Key Takeaways

- Required Minimum Distributions begin at age 73 (or 75 for those born after 1960).

- Planning well ahead of time is the best way to reduce future RMDs and the related tax liabilities.

- RMDs aren’t necessarily something to fear—you may have benefited from decades of tax deferral already.

Required Minimum Distributions: What They Are

Since we let the cat out of the bag, let’s start with the basics: what exactly is a Required Minimum Distribution?

At a certain age—your Required Beginning Date (RBD)—a minimum amount must be withdrawn from your pre-tax retirement accounts. These accounts include funds you contributed pre-tax and that have grown tax-deferred throughout your career. Until now, no taxes have been paid on these dollars, despite the fact that you’ve saved, invested, and controlled them all along.

I often remind clients that their traditional IRA balance isn’t entirely theirs. A portion belongs to federal and state governments. How much depends on planning and the timing and size of account withdrawals. With proactive strategies, we can work to minimize how much ultimately goes to taxes. We wrote an entirely separate blog on tax strategies here!

For individuals who don’t need their IRA funds to live on, the default strategy is to let investments continue compounding tax-deferred. If you don’t need the money, why withdraw it and pay tax? RMDs are designed to interrupt that process. Whether you want to take a withdrawal or not, once you reach your RBD, a minimum distribution—your floor—is required each year.

As they say, the chickens always come home to roost when it comes to paying taxes. We can’t defer forever.

The Basics: When RMDs Begin

RMDs apply to anyone who is age 73 or older (or 75 for individuals born after January 1, 1960). You become subject to RMD requirements in the year you turn 73.

For example, if your 73rd birthday is July 4th, that entire calendar year is your first RMD year. You don’t need to wait until your actual birthday—your RMD can be satisfied anytime after January 1st of that year.

In your first RMD year, you have until April 1st of the following year to take your initial RMD. However, in every year after, the RMD must be taken by December 31st. The break to push your RMD only applies in year 1!

Planning Note:

If you wait until April 1st to take your first RMD, you’ll end up taking two RMDs in the same calendar year due to the fact that after year 1, the deadline becomes December 31st to satisfy your RMD each year.

RMDs establish a minimum withdrawal. If you’re already taking distributions as part of your income plan, you may already be meeting the minimum required. An RMD is NOT automatically in addition to what you might already be taking. However, this calculation must be run annually—and RMDs generally increase as you age, so eventually you may have to adjust your distributions upward.

Accounts Subject to RMDs

Any retirement account funded with pre-tax dollars is subject to RMDs, including:

- Traditional IRAs

- 401(k)s

- 403(b)s

- SIMPLE IRAs

- SEP IRAs

- 457(b) plans

There is an important exception for employer-sponsored plans:

If you are still employed by the company sponsoring the plan, that 401(k)/403(b) is exempt from RMDs—as long as you are not a more-than-5% owner.

Planning Opportunity:

If you have a Traditional IRA and are still working with access to a 401(k), you may be able to roll your IRA into the plan to avoid RMDs until retirement. Once you retire or separate from service, however, the full balance becomes subject to standard RMD rules.

Inherited IRAs, Roth IRAs (during the owner’s lifetime), and most employer plans for retirees are not subject to the aggregation rules discussed later. Inherited IRAs inherited after January 1, 2020 also have their own set of rules for how funds must be distributed.

How RMDs Are Calculated

Let’s return to our example of someone turning 73 on July 4th. Their first RMD must be taken by April 1st of the following year (or earlier). How much must they withdraw?

Step 1: Identify which accounts require RMDs.

Step 2: Find the December 31st balance of the previous year.

This value is used every year for the calculation.

Step 3: Determine the correct IRS table and divisor.

The IRS provides three life expectancy tables:

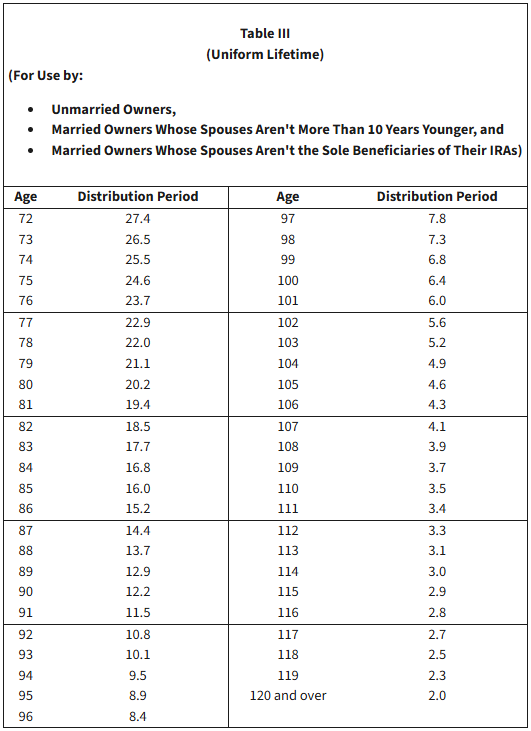

- Uniform Lifetime Table (used by ~90% of individuals)

- Joint Life and Last Survivor Table (for spouses more than 10 years younger who are sole beneficiaries)

- Single Life Table (primarily for beneficiaries)

Most retirees will use the Uniform Lifetime Table found here.

Step 4: Apply the formula:

RMD = December 31 Balance ÷ Applicable Distribution Period

In our example, a retiree turning 73 uses a divisor of 26.5.

If their December 31 IRA balance was $1,000,000, their RMD will be:

$1,000,000 ÷ 26.5 = $37,735.85

If they delay their first distribution until April 1st of the following year, they’ll need to take two RMDs in that same year. Below, we’ve put the current Uniform Table. You’ll notice over time the divisor (distribution period) decreases. Assuming your balance stays about the same, this means your RMD will increase annually.

The approximate percentage distribution for the RMD at age 73 is 3.77%. At age 85 it is 6.25%. At age 90 it is 8.2%. One thing you can count on with RMDs, is your tax bill will likely increase throughout retirement.

Penalties for Missing an RMD

Failing to take an RMD can result in a penalty of 25% of the amount not withdrawn. If corrected within the IRS “correction window,” the penalty can be reduced to 10%.

The correction window runs until the latest of:

- January 1 of the year the IRS issues a deficiency notice

- The date the tax is assessed

- The last day of the second year after the tax was imposed

Penalties may be waived for “good cause,” but this requires filing Form 5329 during the “correction window”. This is more than likely going to be by January 1st of the year following the tax that was assessed on your RMD. On top of filing form 5329, you’ll want to satisfy the required distribution and include a letter with your filing on why the RMD was missed as well as detailing the corrective action.

The bottom line: know your deadlines, and have a plan.

Aggregating Account Values

Many people get tripped up when they have multiple accounts.

For Traditional IRAs, the IRS allows aggregation. This means the total RMD can be taken from any one IRA.

For example, if you have two IRAs worth $500,000 each, and your combined RMD is $37,735.85, you can take the full amount from one IRA.

However, you cannot aggregate across different plan types. 401(k)s and 403(b)s each require separate calculations and separate distributions.

Planning for RMDs

Generally, you have three choices when it comes to RMD dollars:

- Spend them

- Save or journal shares to a taxable account

- Donate them through a Qualified Charitable Distribution (QCD)

Once RMDs begin, they continue for life—and as we’ve seen, increase over time. This means RMDs will more than likely raise your tax liability across retirement.

The best planning is done well in advance. With clients, we model the long-term impact of RMDs and how they affect lifetime taxes. Outside of charitable strategies, the primary option is simply to pay taxes when due—but with planning, we can make those taxes more manageable.

Qualified Charitable Distributions (QCDs)

A QCD is a direct transfer from your IRA to a qualified charity.

Here’s why they matter:

If you are subject to RMDs, a QCD can satisfy all or part of your RMD—without creating taxable income.

You can perform a QCD once you reach age 70½ (you must actually be 70½—not just turning 70½ that year). This allows the strategy to be used before RMDs begin at age 73.

QCD Rules

- The annual limit is $115,000 (2026).

- The charity must be a qualified 501(c)(3).

- The distribution must go directly from your IRA to the charity.

- You cannot fund a Donor-Advised Fund with a QCD.

QCDs are among the most powerful planning tools for retirees because most charitable donations offer limited tax benefits under the standard deduction. QCDs offer a way to achieve maximum tax savings while supporting causes you care about.

If an RMD would push you into a higher tax bracket, phase out a deduction, or trigger another tax cliff, a QCD can help offset those consequences entirely.

In Summary

RMDs are more than just a required withdrawal—they’re a key part of your long-term retirement tax plan. While most people know something happens “around age 70,” the actual rules are more nuanced. Understanding the timing, calculation, and planning opportunities surrounding RMDs can help you avoid penalties and reduce lifetime taxes.

Early planning is the best way to stay proactive, reduce unnecessary surprises, and make informed decisions about your future withdrawals.